what is an example of an ad valorem tax

The most common ad valorem. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

Ad valorem sentence example.

. Learn more about ad. 3 Examples of Ad Valorem Taxes. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

Imports are charged 8 exports 1 ad valorem duty. What is an example of an ad valorem tax is. An ad valorem tax is a tax that is based on the assessed value of a property product or serviceThe most common ad valorem tax examples include property.

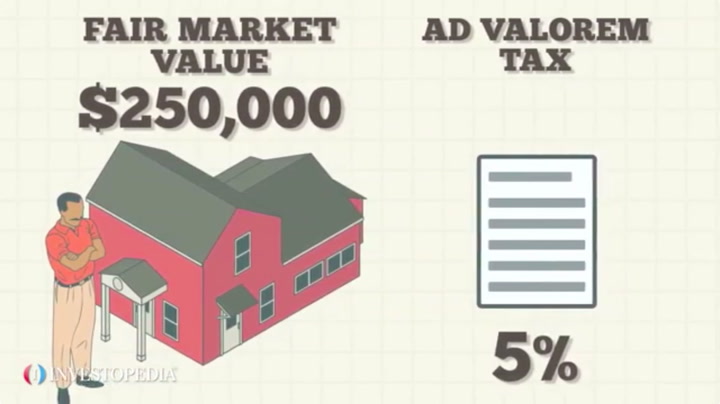

In a nutshell ad valorem tax is a type of tax that is charged on property according to the propertys value. An ad valorem tax imposes a more comparable burden across both businesses. A good example of the ad valorem tax is a local property tax which is assessed annually on the value of an owners residence and property.

An ad valorem tax is based on the value of an item at the time of the transaction or assessment. The name of the tax stems from a Latin phrase and means according to value. The most common ad.

What is an example of an ad valorem tax is. For example if this tax is applied to the value of a property every year the tax burden will increase. Property tax is an example of ad valorem tax that an owner of residential commercial or real estate property pays on the value of their owned property.

What is an example of an ad valorem tax. Register and Subscribe now to work with legal documents online. An ad valorem tax is a tax that is based on the assessed value of a property product or service.

What is an example of an ad valorem tax is. The most common ad valorem taxes are property taxes levied on. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

An ad valorem tax allows to easily adjusting the amount to be paid in any given occasion. An ad valorem tax is a tax that is based on the assessed value of a property product or service. Ad valorem taxes are taxes determined by the assessed value of an item.

An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. One prime example is the Value Added Tax VAT which varies in percentage depending on the assessed value of the. Property tax is a form of ad valorem tax levied on the value of the real estate or other residential and commercial properties paid by the.

The most common ad. What is an example of an ad valorem tax is. Ad Get Access to the Largest Online Library of Legal Forms for Any State.

Ad valorem taxes are taxes determined by the assessed value of an item. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. The most common ad valorem tax examples include property taxes on real estate sales tax on.

The most common ad valorem tax examples. However ad valorem taxes have the disadvantage of imposing taxes regardless of the cost to. Homeowners property taxes are.

495 37 votes. An example of an Ad Valorem Tax. Local government entities may levy an ad valorem tax on real estate and other major personal property.

One prime example is the Value Added Tax VAT which varies in percentage depending on the. About 4000 were thus annually imported and an ad valorem duty was levied by the. Ad valorem tax is a common form of taxation on real property such as.

Ad Valorem Tax. An ad valorem tax is a tax that is based on the assessed value of a property product or service. The most common ad valorem tax examples include property taxes on real estate sales tax on.

The most common ad valorem tax examples. An ad valorem tax is a tax based on the assessed value of an item such as real estate or personal property. Ad pdfFiller allows users to edit sign fill and share all type of documents online.

Property Tax Definition Uses And How To Calculate Thestreet

Real Estate Property Tax Constitutional Tax Collector

Ad Valorem Tax 3 Examples Of Ad Valorem Taxes 2022 Masterclass

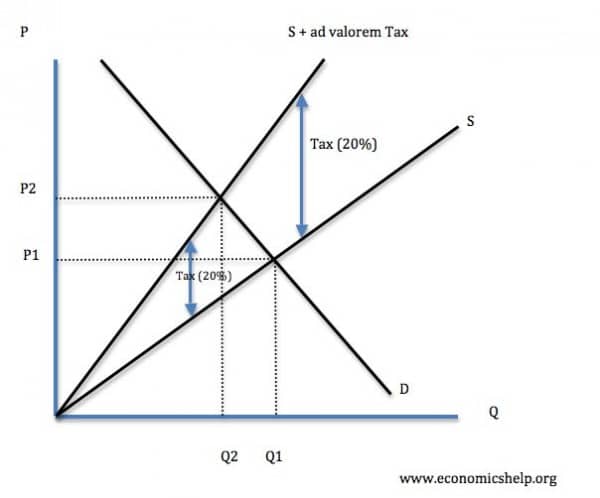

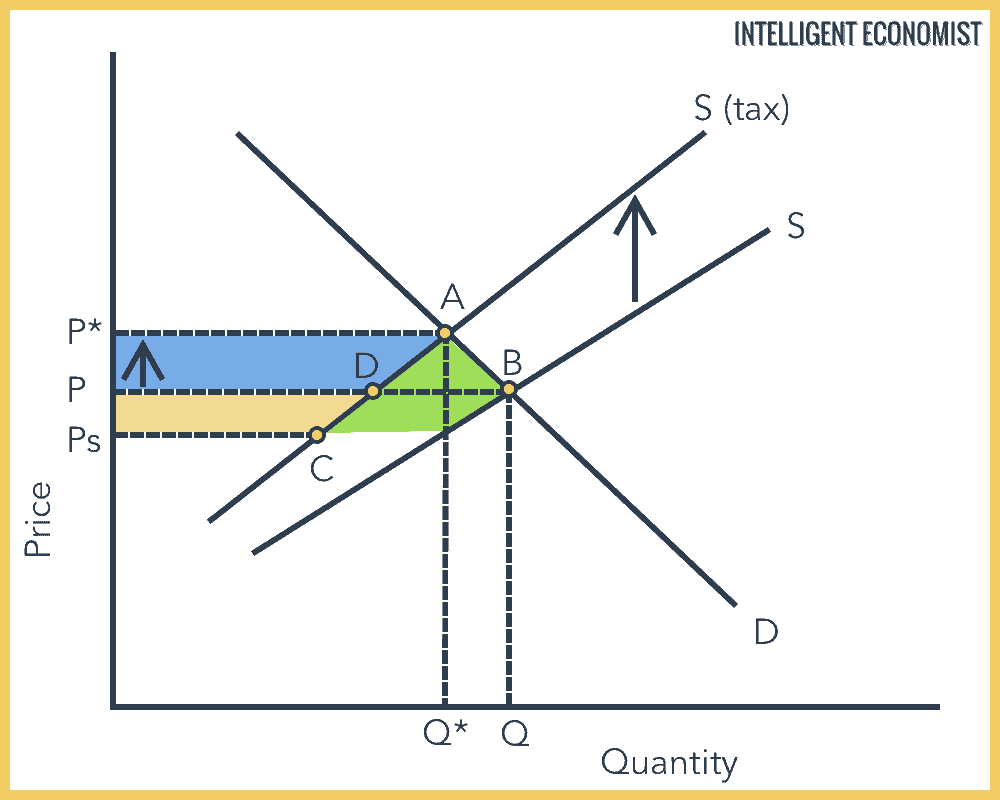

Indirect Tax Intelligent Economist

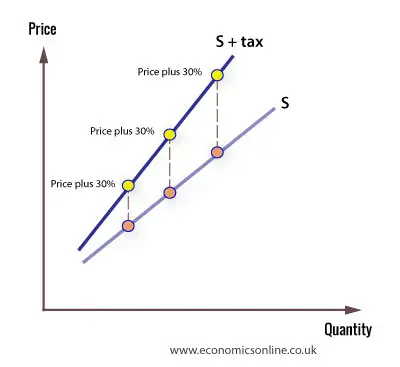

Dp Economics Indirect Taxation

Understanding California S Property Taxes

Ad Valorem Tax Definition And How It S Determined

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Ad Valorem Tax Overview And Guide Types Of Value Based Taxes

Ad Valorem Tax In Texas Texapedia The Encyclopedia Of Texas Civics

/6355404323_7ec7219643_k-035f3f9902fe47db8ef2f2ff7cf82738.jpg)

Ad Valorem Tax Definition And How It S Determined

What Is An Ad Valorem Tax Economics Definitions Mr Banks Tuition Tuition Services Free Revision Materials

Adjusted Annual Property Tax Bill Los Angeles County Property Tax Portal

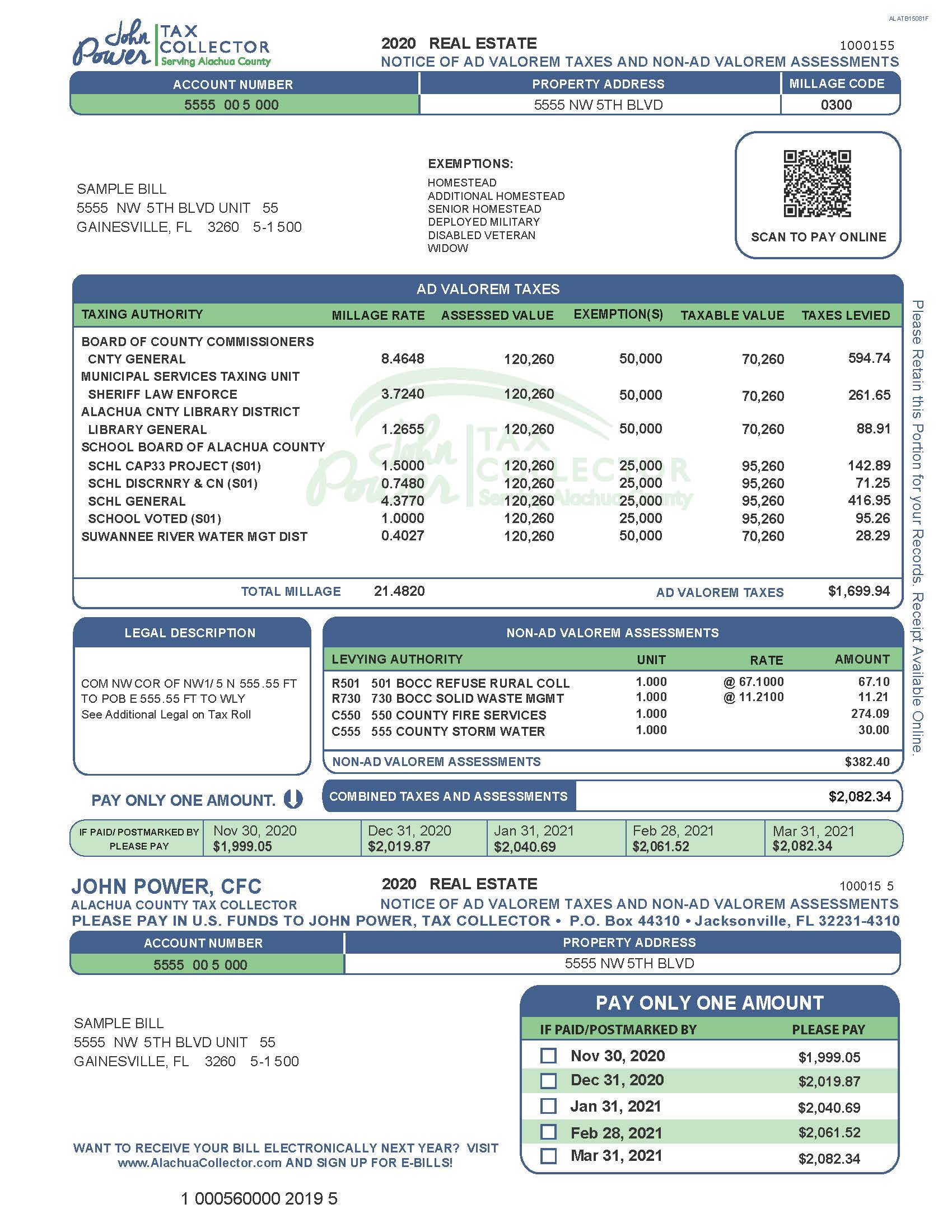

A Guide To Your Property Tax Bill Alachua County Tax Collector